外貿出口英語-想成為外貿創業中國合伙人嗎?那得先了解合伙人如何持股如何分紅的

很多朋友想象中國合伙人一樣成立合伙投資的外貿公司共同創業。

但是在投資之前,需要對如何投資,如果分紅這些資本運作的基本概念有一個了解。

下面以一個賈亞爾摩托公司的資本運作為例,為大家介紹一下最基本的概念:

The total equity capital of Jayal Motors is 600,000 Euros in the form of ordinary shares and debentures.

賈亞爾摩托的股本總額為60萬歐元,以普通股和債券的形式。

Debentures are a safe form of investment as they are really a form of loan. If the company goes bankrupt, the debenture-holders are paid back before any other creditors.

債券是一種安全的投資形式,因為它們是一種貸款形式。 如果公司破產,債權人將在任何其他債權人之前得到償還。

Debenture-holders receive a fixed rate of interest each year (here 10%). The bank owns all the debentures in Jayal Motors,

債券持有人每年獲得固定利率(這里為10%)。 該銀行擁有賈亞爾摩托的所有債券,

(Jayal Motors have also borrowed 200,000 Euros from the bank, They must pay 15% interest on this loan to the bank each year.)

(賈亞爾摩托也從銀行借款了20萬歐元,他們每年必須向銀行支付15%的利息。)

Jayal Motors ordinary shares are owned by Tom. Paul, Tara, and Jack.

賈亞爾摩托普通股由湯姆, 保羅,塔拉和杰克持有。

Any profit the company makes is divided between the shareholders in the form of a dividend after all the interest has been paid on loans and debentures,

公司所賺取的任何利潤在所有貸款和債券的利息已經支付之后,以股利的形式在股東之間分配,

Before the dividend is paid. Jayal Motor also subtract 5,000 Euros, which they put back into the business each year (this money is called "retained profits")

在股息支付之前。 賈亞爾摩托也減去了5000 歐元,他們每年都再投入業務(這筆錢稱為“留存利潤”)

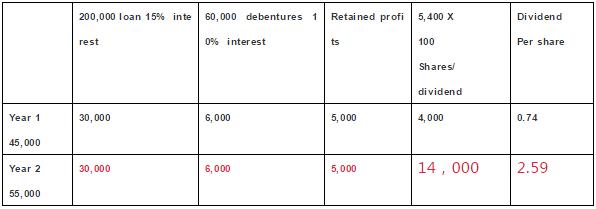

The company's estimated income for the next two years is:

該公司未來兩年的預計收入為:

First year: 45,000 Euros.

第一年:45,000 歐元

Second year:55,000 歐元.

第二年:55,000 Euros。

How will this money be distributed with the company's present financial structure? the figures for year one are already filled in on the this table, fill in the figures for year two.

這筆資金將如何與公司目前的財務結構一起分配? 第一年的數字已填入本表,請你自己計算并填寫第二年的數字。

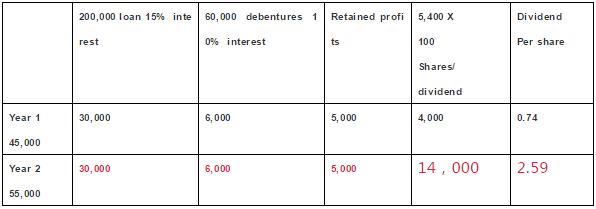

Carl and Eve are contributing 200,000 Euros to Jayal Motors in the from of ordinary shares, Because of this, Jayal Motors can pay back the 200,000 Euros loan to the bank.

卡爾和夏娃向賈亞爾摩托提供的普通股為20萬歐元,因此,賈亞爾摩托可以向銀行支付20萬歐元的貸款。

Draw up a table like the above to show how the estiamted income for the next two year will be distributed under the company's new captial stucture.

制定一個表格,如上所述,顯示未來兩年的收入將如何分配到公司的新資本。